Income Tax Rebate 2025 Assessment Overview

Income Tax Rebate 2025 Assessment Overview. Income tax relief in 2025: In the old tax regime, taxpayers have the option to claim various tax deductions and exemptions.

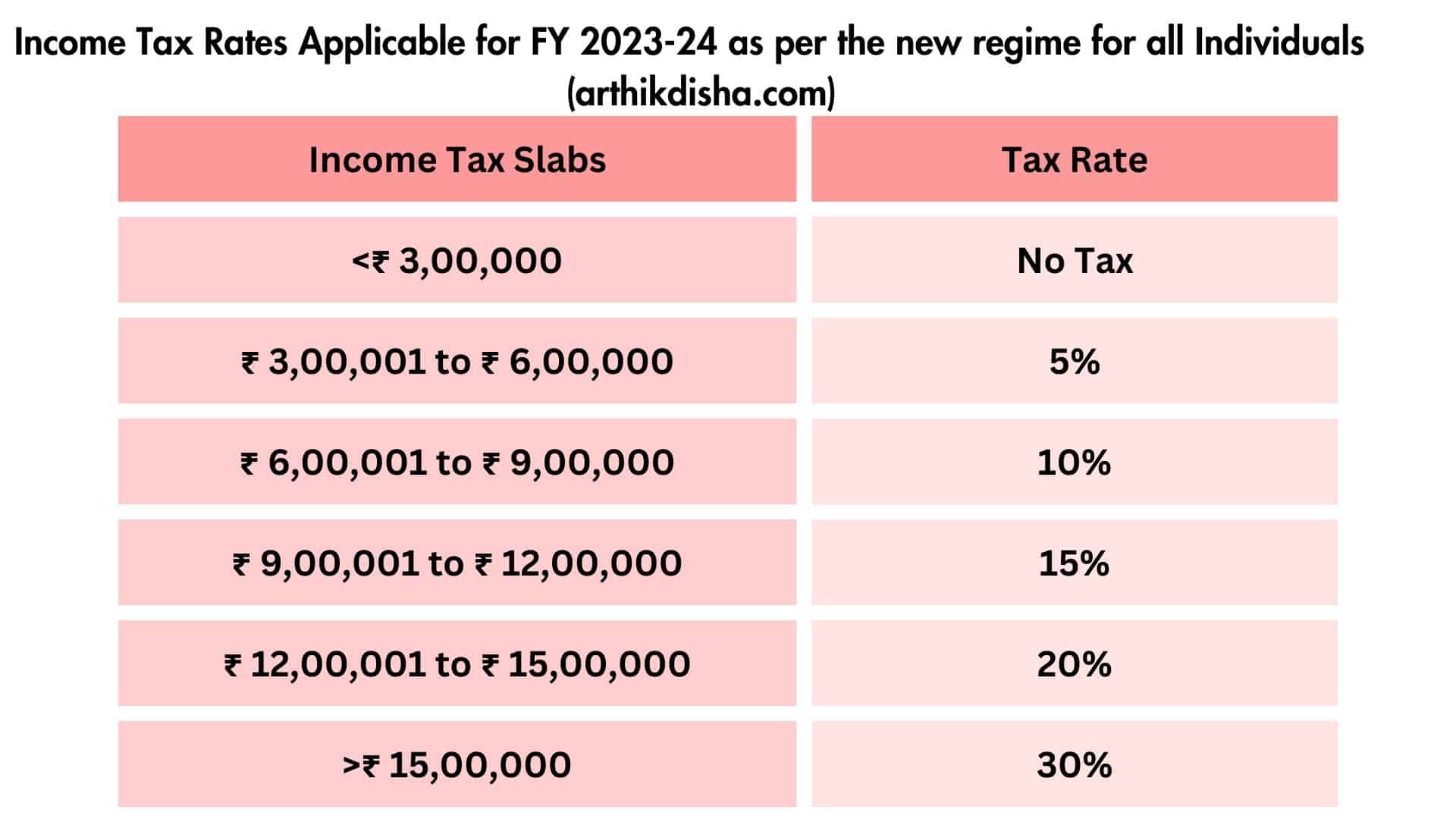

Income tax budget 2025 explained: Section 87a provides eligible taxpayers with a full income tax rebate if their total income is below rs 5 lakh under the old. Income tax relief in 2025:

Source: amyjmoore.pages.dev

Source: amyjmoore.pages.dev

How Long To Get Tax Refund 2025 Theresa V. Parker The finance minister has announced an increase in the tax rebate under section 87a to rs 60,000 from rs 25,000 under new tax regime currently. Section 87a provides eligible taxpayers with a full income tax rebate if their total income is below rs 5 lakh under the old.

Source: mariajdeloach.pages.dev

Source: mariajdeloach.pages.dev

Tax Rebate 2025 Trending Maria J Deloach The finance minister has announced an increase in the tax rebate under section 87a to rs 60,000 from rs 25,000 under new tax regime currently. Section 87a provides eligible taxpayers with a full income tax rebate if their total income is below rs 5 lakh under the old.

Source: jasondcombs.pages.dev

Source: jasondcombs.pages.dev

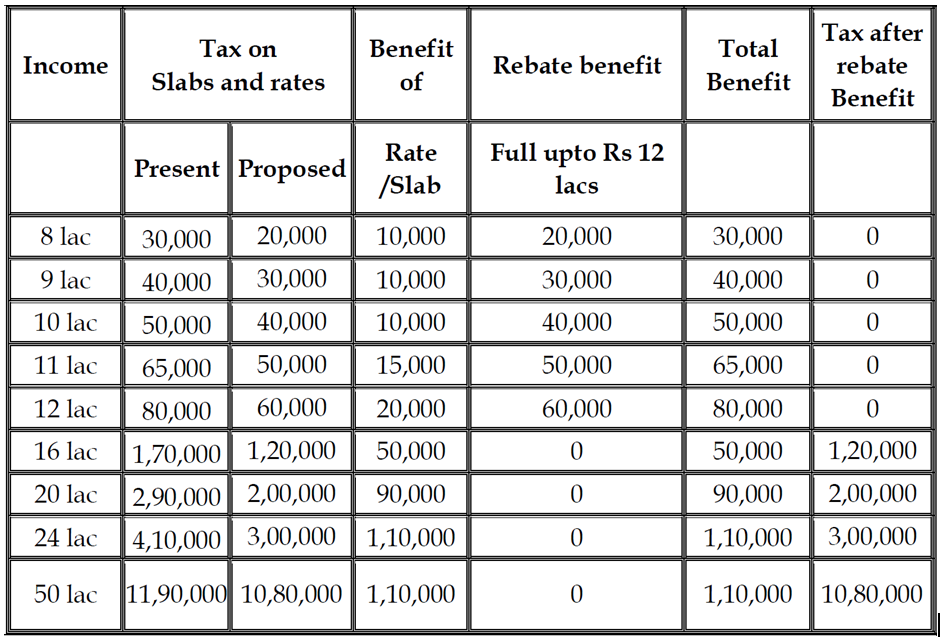

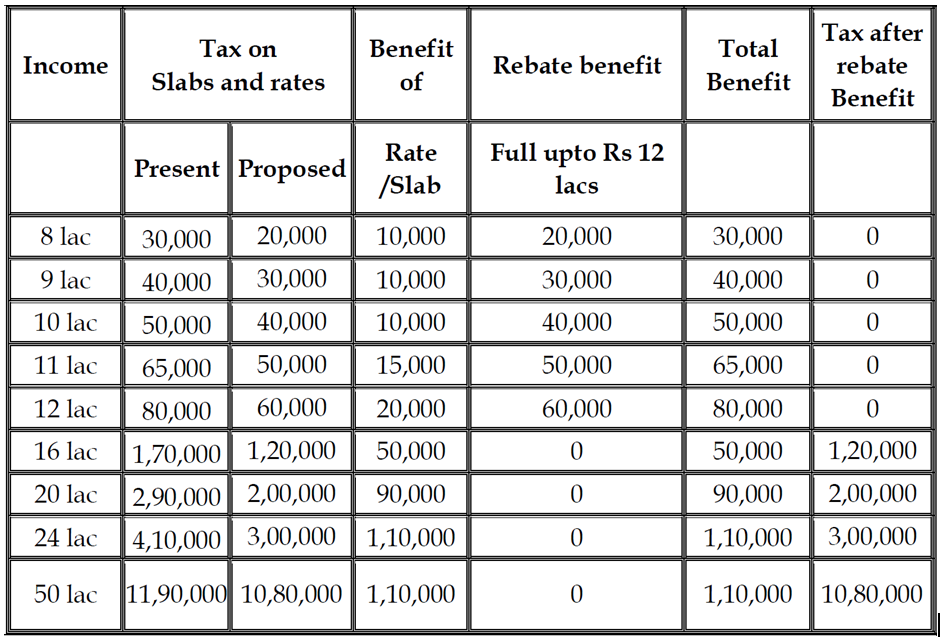

Tax Refund Schedule 2025 Calculator Jason D. Combs Key highlights of the new tax rebate resident individuals with net taxable income up to rs 12 lakh will no longer have to pay income tax. Income tax relief in 2025:

Source: indianexpress.com

Source: indianexpress.com

Tax Slabs Budget 2025 LIVE Updates New Tax Slab and Income tax relief in 2025: Key highlights of the new tax rebate resident individuals with net taxable income up to rs 12 lakh will no longer have to pay income tax.

Source: studycafe.in

Source: studycafe.in

Tax Rebate under Old and New Tax Regime for FY 202526 Key highlights of the new tax rebate resident individuals with net taxable income up to rs 12 lakh will no longer have to pay income tax. 7,00,000 under the new tax regime.

Source: www.youtube.com

Source: www.youtube.com

New Tax Slab Rates FY 202425 (AY 202526) by Budget 2024Rebate 7,00,000 under the new tax regime. Income tax relief in 2025:

Source: arthikdisha.com

Source: arthikdisha.com

Tax Rebate U/S 87A for AY 202425 & FY 202324 Section 87a provides eligible taxpayers with a full income tax rebate if their total income is below rs 5 lakh under the old. Income tax relief in 2025:

Source: www.taxbuddy.com

Source: www.taxbuddy.com

Section 87A Tax Rebate to Maximize your Tax Savings Income tax budget 2025 explained: Key highlights of the new tax rebate resident individuals with net taxable income up to rs 12 lakh will no longer have to pay income tax.

Source: maryquinn.pages.dev

Source: maryquinn.pages.dev

Tax Proposals In Budget 202524 Mary Quinn This means a resident individual with taxable. Income tax budget 2025 explained:

Source: www.caclubindia.com

Source: www.caclubindia.com

Budget 202526 No Tax on Annual Upto Rs. 12 Lakh Under Income tax budget 2025 explained: Key highlights of the new tax rebate resident individuals with net taxable income up to rs 12 lakh will no longer have to pay income tax.

Source: amyjmoore.pages.dev

Source: amyjmoore.pages.dev

How Long To Get Tax Refund 2025 Theresa V. Parker In the old tax regime, taxpayers have the option to claim various tax deductions and exemptions. Key highlights of the new tax rebate resident individuals with net taxable income up to rs 12 lakh will no longer have to pay income tax.

Source: www.upexciseportal.in

Source: www.upexciseportal.in

IRS Tax Refund Schedule for 2025 Important Dates You Need to In the old tax regime, taxpayers have the option to claim various tax deductions and exemptions. Income tax budget 2025 explained: